Understanding LPP: Your complete guide to occupational benefits in Switzerland

The LPP, or Loi fédérale sur la Prévoyance Professionnelle (Federal Law on Occupational Pensions), is regularly at the heart of the news, and above all indispensable for our pensions. Recently, the Federal Council announced that compulsory pension assets would earn interest at 1.25%. Good news indeed, but what is LPP after all?

Context and objectives

The LPP is relatively recent, having come into force in 1985. It was designed to complement the AVS and ensure that the previous standard of living was adequately maintained. The AVS "only" guarantees a minimum standard of living (see the 3-pillar system, below).

As a topical issue of growing importance because of Switzerland's socio-demographic context, particularly the aging population, it is increasingly debated, and adjustments are regularly decided upon.

3-pillar systems

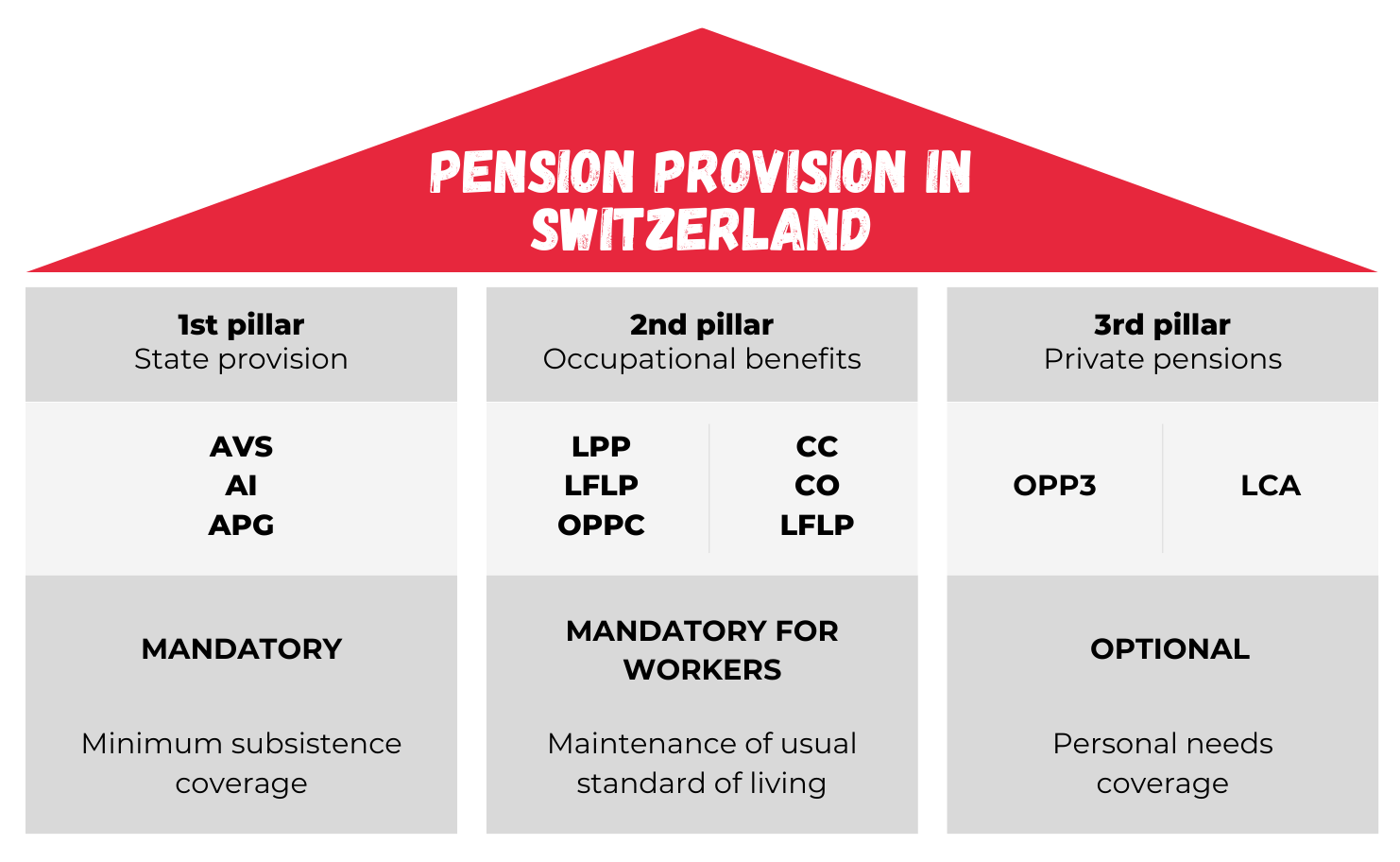

The LPP is the second component of the 3-pillar pension system in Switzerland. This system, which is intended to cover our needs after retirement age (or in the event of disability/death for survivors), is based on state pension provision (AVS/AI), occupational pension provision (LPP), and private pension provision (3rd pillar).

Legal framework

The "Loi sur la Prévoyance Professionnelle" (LPP) sets out the minimum requirements that pension funds must meet as part of the compulsory scheme. In addition to these minimum requirements, pension funds can provide more attractive benefits through their regulations or bylaws, known as the "super-mandatory" scheme.

This is a mandatory benefit for the vast majority of employees. However, certain criteria may invalidate this obligation, such as a fixed-term contract of less than 3 months, or for employees under the age of 17.

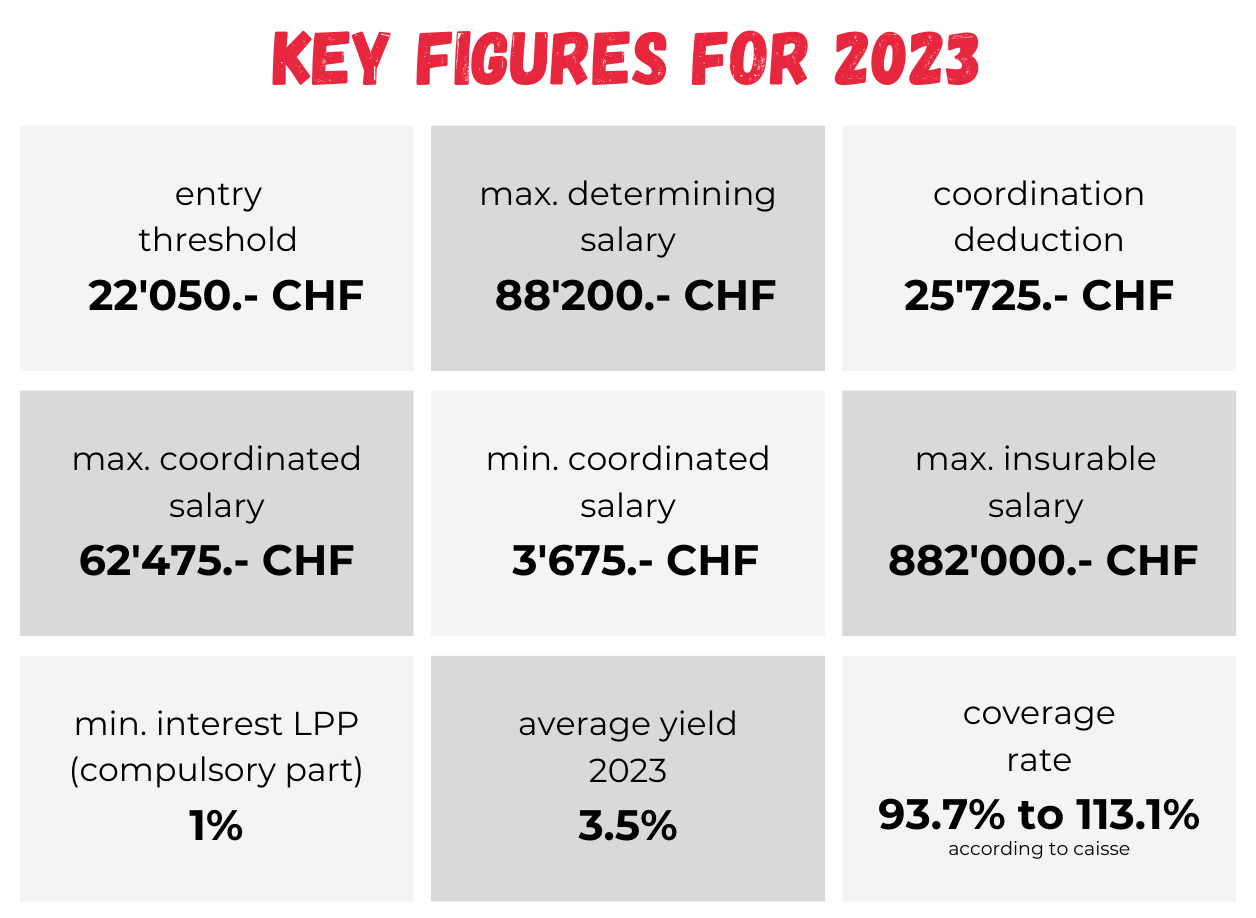

Coverage commences at the same time as the employment relationship and ends when the entitlement to retirement benefits arises, with the termination of the contract, or when the membership threshold (CHF 22,050) is no longer reached. For the risk component (death/disability), coverage continues one month after termination of employment.

Affiliation is the employer's responsibility. It is the employer who registers employees with the pension fund, pays the contributions (deducting a maximum of 50% from employees), notifies changes or terminations, etc.

Subscriptions

At the very least, contributions must be shared equally. In other words, the employer must pay at least 50% of the contributions. However, the employer is free to pay a higher percentage, thereby reducing the contribution paid by the employee.

Contributions are divided into 3 parts:

- Savings component: directly added to the employee's pension assets

- Risk component: to anticipate the cost of future disability/death benefits

- Management fees: Paying for pension fund services

As mentioned above, the contribution depends, among other things, on the age of the employee.

Age-based annuities and specific percentages have been defined:

- 17-24: 0% of insured salary

- 25 – 34: 7%

- 35-44: 10%

- 45-54: 15%

- 55-64: 18%

These rates represent the minimum required by law. Pension plans offered by pension funds may offer higher rates.

When choosing an employer, the latter's pension fund can be a decisive criterion, enabling you to benefit from a more advantageous pension plan and sometimes lower contributions.

Retirement savings

The retirement savings capital corresponds to the insured's savings. It is built up through several variables:

- Contributions deducted through payroll (employee and employer)

- Retirement assets transferred from a former pension fund

- Interest offered by the Caisse

Let's focus on the last 2 points.

1. Retirement savings transferred from another fund

As each employer is affiliated with a pension fund, the insured needs to transfer his or her assets when changing employers, and therefore pension fund. If this is not done, the former pension fund will transfer the assets in question to a vested benefits account.

If you haven't done this when changing employers and don't know where your assets are, you can take the necessary steps and retrieve your assets free of charge thanks to KALA.

2. Interest income

The pension funds put their policyholders' money to work, for example by investing in real estate, equity/bond markets, etc. Whatever their performance, a minimum interest rate, calculated on the mandatory portion, must be paid out to each policyholder. Whatever their performance, a minimum interest rate, calculated on the mandatory portion, must be paid to each member (1% in 2023, 1.25% in 2024). However, each pension fund is free to pay more if it wishes.

Buybacks

Under certain conditions, you can buy back contribution years to increase your assets and close pension gaps. The maximum purchase amount is determined by the maximum benefits available under the pension plan regulations.

Pension gaps are defined as non-contributory years and/or lower-than-current salaries. Purchases are intended to bridge these gaps. They can then be deducted from taxable income.

Please note that any purchase can only be withdrawn after 3 years (old-age pension, property purchase, etc.).

Asset withdrawals

Withdrawal of assets is possible in the following situations:

1. Retirement benefits

At retirement age (64 for women, 65 for men), the insured receives a pension based on the total amount of his assets and a conversion rate (6.8% in 2023). The latter, applied to the total amount of assets, defines the annual pension to which the insured will be entitled until his or her death. The conversion rate is calculated based on statistics on the average mortality age and is applied to the amount of the compulsory plan. In the case of an over-mandatory plan, the pension fund may propose a lower rate.

Benefits are most often paid in the form of monthly annuities.

However, under certain conditions, part (1/4 in Switzerland) or all of the assets can be withdrawn as a lump sum.

2. Buying real estate

LPP pension assets can be used to purchase your own home. Insurers may only use their occupational pension funds to purchase one property at a time, with a minimum advance withdrawal of CHF 20,000.

3. Starting a self-employed business

If the insured wishes to become self-employed, he or she is no longer obliged to contribute to the 2nd pillar and can withdraw the accumulated capital.

4. Final departure from Switzerland

It is possible to withdraw capital before retirement in the event of a permanent move to a country outside the European Union (EU) or the European Free Trade Association (EFTA).

Conclusion and news

The primary aim of this article was to provide a simple, concise explanation of the main aspects of occupational pension provision. It is important to stress that this is a particularly wide-ranging field, which means that certain important topics, such as regulation and supervision, divorce-related issues, and benefits in the event of disability or death, could not be included in this article, but merit further exploration.

Concerning recent developments, a reform is scheduled to be put to the vote in 2024, to secure pensions and consolidate funding sources. However, this reform will be accompanied by a reduction in the conversion rate to 6%.

The performance of pension funds has also come under scrutiny of late. According to a study by Swisscanto, average returns in 2022 will be -8.8%.

To conclude this article, we present below some key data for the year 2023.

At Helvetic Payroll, we understand how important employee benefits are to our consultants.

That's why we offer several plan options, tailored to each individual's objectives, whether to maximize savings, net salary or to establish a split between employee and employer.

If you have any questions, please don't hesitate to contact us - we'd be delighted to provide you with personalized advice.

0 comment