How does payrolling work in Switzerland?

Payrolling, also known as service leasing, is a form of employment that allows you to work as a consultant for the clients of a service company such as Helvetic Payroll. In Switzerland, this method is gaining in popularity because of its ability to offer flexibility that is increasingly in demand.

As part of our payrolling services, we propose that our consultants establish an employer-employee relationship governed by the LSE (Federal Law on Employment Services and the Hiring of Services). Then, as a Helvetic Payroll employee, we place you at the client's disposal to carry out the assignment that we have agreed together.

Do you have any questions about this form of employment? Helvetic Payroll offers you a complete guide to everything you need to know about payrolling: definition, how it works, benefits, compliance and legislation, we explain it all here!

📌What is payrolling?

PRINCIPLE AND DEFINITION

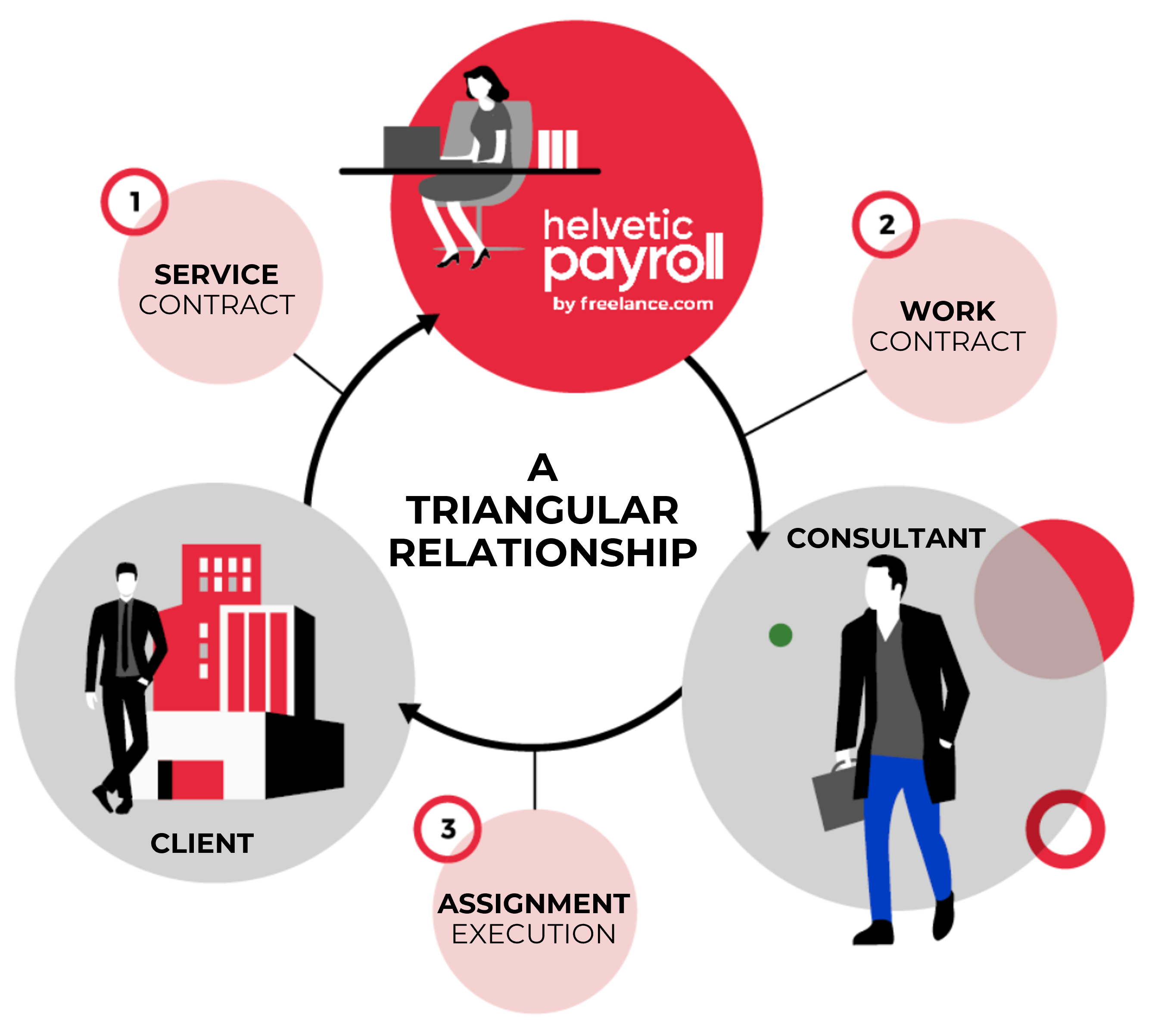

Payrolling is a tripartite contractual relationship between a payrolling company, a consultant, and the client company for which the consultant’s services are provided. It differs from other forms of employment in that it offers great flexibility through its compromise between salaried employment and autonomy.

Two types of contract are concluded between the various parties:

- An employment contract: concerns the consultant and the payrolling company, and contains the same clauses as any other salaried contract. It includes all the regulatory clauses defined by the LSE.

- An assignment contract: summarises the conditions under which the employee will carry out the assignment for the client.

Payrolling offers an attractive alternative for talented individuals wishing to work as consultants while enjoying a degree of stability and compliance in both social and financial terms.

⚙️How does Swiss payrolling work?

Before taking on a consulting assignment with a payrolling company in Switzerland, it is essential to understand the basics of this form of employment.

The way it works is simple:

- The consultant becomes an employee of the payrolling company, which handles all the administrative formalities, taxes, and social security contributions on his behalf. A triangular relationship is established between the payrolling company, the salaried consultant, and the client company.

- An assignment contract governs the relationship between the payrolling company and the client company, while an employment contract governs the relationship between the payrolling company and the consultant.

- The detailed specifications of the assignment govern the relationship between the consultant and the client.

⭐️ What are the advantages of payrolling?

Payrolling provides consultants with a solution that frees them from administrative and legal constraints, while offering the advantages and security of employee status, allowing them to concentrate fully on the quality of their services.

- Simplification of administrative management: payrolling offers a solution that preserves a degree of flexibility while relieving consultants of administrative tasks such as invoicing, client follow-ups, accounting, and dealing with public bodies. This approach allows consultants to focus entirely on their assignments.

- Secure status: payrolling companies monitor the payment of consultants’ salaries by interacting with clients to guarantee their remuneration. They also ensure that these professionals comply fully with Swiss legislation.

- Social benefits: Consultants are issued with a Swiss work certificate, ensuring full social cover, including health insurance, pensions, unemployment insurance, and work-related accidents.

- Financial optimisation: payrolling companies offer consultants financial security by ensuring a regular income. Their specialist teams also help them to optimise their income, guaranteeing the best possible salaries.

Helvetic Payroll is a payrolling company dedicated to helping consultants and employees realise their projects by offering them services tailored to their needs.

📍The Swiss system

SOCIAL INSURANCE

In Switzerland, social protection is a key concept in the social system. It aims to protect citizens against social risks such as illness, accidents, unemployment, old age, disability and death. It therefore includes a range of social insurance schemes to cover the costs associated with these risks:

- Health insurance (LAmal) consists of compulsory care insurance and optional daily allowance insurance.

- The loss-of-earnings allowance (APG) provides maternity, paternity and childcare allowances (for sick children).

- Old-age, survivors’ and disability insurance, comprising the “3 pillars”: old-age and survivors’ insurance (AVS) and disability insurance (AI), occupational old-age, survivors’ and disability insurance (PP) (compulsory for employees) and personal insurance (optional).

- Occupational and non-occupational accident insurance (AA)

- Unemployment insurance (AC)

- Family benefits

Except for the 3rd pillar, all these insurance schemes are compulsory.

In short, Swiss social protection is a comprehensive and effective system that enables citizens to face up to life’s social risks while benefiting from financial support and professional assistance in times of need.

COVER FOR OLD AGE, SURVIVORS, AND INFIRMITY

The Swiss social protection system covers the following areas:

- The 1st pillar, provided by the public authorities, comprises the AVS and the AI. Pensions from these two insurance schemes are intended to cover the basic needs of insured persons. The 1st pillar is compulsory for everyone, including the self-employed and those not in work.

- The 2nd pillar (LPP) supplements the 1st pillar with occupational provision for old age, survivors and invalidity. These two pillars guarantee insured persons who retire at least 60% of their last salary. The second pillar is compulsory for employees only.

- The 3rd pillar, i.e. individual provision to cover more extensive needs, is optional, but benefits in part from tax advantages, unlike other forms of savings. The funds can only be paid out in the event of certain events (retirement, death or disability) or for the purchase, under certain conditions, of one’s own home.

FAMILY BENEFITS

Under the federal system, family allowances are managed by the cantonal compensation funds and, under the cantonal systems, by the family allowance funds (recognised professional or inter-professional funds and cantonal funds).

COMPULSORY SWISS HEALTH INSURANCE

Compulsory health insurance guarantees everyone living in Switzerland access to high-quality medical care and appropriate medical treatment in their canton of residence. Health insurance for medical expenses is required by law in Switzerland.

This private insurance, which must be taken out within 3 months of your arrival in the country, is the responsibility of the employee. The amount varies according to the level of coverage you require.

TAXES AND TAX LAW IN SWITZERLAND

Taxes and the Swiss tax system are complex in that the rules are not the same depending on your type of permit (cross-border commuter or resident in Switzerland), your salary level and your canton of work. Taxes in Switzerland are also complicated by the number of cantons (each canton has its tax system). However, the way tax is calculated in Switzerland is fairly straightforward compared with other countries. Our teams can help you calculate your tax liability.

THE LEGAL SYSTEM

An employment contract is not enough to work in Switzerland as a foreigner: you also need a Swiss work permit. A Swiss work permit is an official document issued by your canton’s population service, permitting you to work in Switzerland.

The main work permits for EU nationals are as follows:

- B permit for long-term residents

- The L permit for short-term residents or work of less than one year

- The C permit, which is a settlement permit after 5 years residence in Switzerland

- The G permit for cross-border workers living in a European Union country.

For more information, please consult our article on this subject or contact our teams.

📝 Conformity and legislation

WORKING IN SWITZERLAND: THE LAW

To work legally in Switzerland, a worker must obtain a Swiss work permit, which a Swiss employer must request from the authorities. Any consultant wishing to work for a company based in Switzerland must therefore work with a Swiss company that is authorised to hire out work in that country.

Consequently, a consultant cannot work for a company based in Switzerland and be paid by a company based abroad. Nor can he work for a Swiss company that does not have the necessary licences. A Swiss end company can only work with a Swiss company that has all the necessary authorisations.

This is the case with Helvetic Payroll, which has all the necessary licences to support your business.

CANTONAL AND FEDERAL LICENCES

Private placement and service rental in Switzerland are strictly controlled by public institutions. Helvetic Payroll holds all the authorisations required for our activities:

- Cantonal authorisation granted by the SPE to operate throughout Switzerland

- Federal authorisation granted by SECO for cross-border activities.

These authorisations allow us to operate in Switzerland and the countries of the European Union.

Helvetic Payroll is in constant contact with the authorities and insurance companies (SECO, SPE, AFC, AVS) to ensure that our processes comply fully with Swiss legislation. The penalties for non-compliance, for example, with the payment of social security contributions, can be extremely severe, which is why it is so important for our customers to make sure in advance that they are not running any risks in this respect.

We know that it is of the utmost importance to ensure that each employee’s payslip is drawn up in strict compliance with Swiss and European standards, particularly when it comes to calculating social security contributions and tax deductions when taxation is carried out at source.